Bitcoin is the most popular cryptocurrency in the world, and its trading is a lucrative business. However, trading Bitcoin can be complicated, and it requires a lot of time and effort. One way to make the process easier is to automate your Bitcoin trading strategies with bots and algorithms. In this article, we’ll explore how you can do that.

What are bots and algorithms?

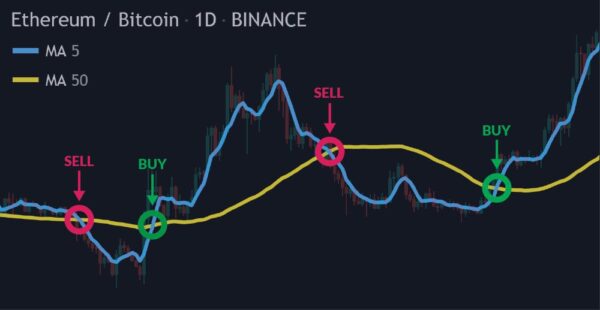

Bots and algorithms are computer programs that execute trades automatically based on predefined rules. These rules can be based on technical analysis, news events, or any other criteria you choose. Bots and algorithms are designed to take emotion out of trading and make decisions based on data and logic.

Why automate your Bitcoin trading strategies?

Automating your Bitcoin trading strategies has several advantages:

- 24/7 Trading: Bots and algorithms can trade Bitcoin 24/7, without the need for you to be constantly monitoring the market.

- Speed: Bots and algorithms can execute trades much faster than humans, which is crucial in a fast-moving market like Bitcoin.

- No Emotion: Bots and algorithms don’t have emotions like fear or greed, which can cloud human judgement and lead to bad decisions.

- Backtesting: Bots and algorithms can be backtested on historical data to see how they would have performed in the past. This can help you refine your strategy and make better decisions in the future.

How to automate your Bitcoin trading strategies?

There are several ways to automate your Bitcoin trading strategies:

- Use a pre-built bot: There are several pre-built bots available that you can use to automate your Bitcoin trading. These bots come with predefined strategies and can be customized to suit your needs.

- Build your own bot: If you have programming skills, you can build your own bot from scratch. This gives you complete control over the bot’s strategies and behavior.

- Use an algorithmic trading platform: There are several algorithmic trading platforms available that allow you to create and backtest your own trading algorithms. These platforms usually require some programming knowledge but are easier to use than building your own bot from scratch.

Things to consider when automating your Bitcoin trading strategies

When automating your Bitcoin trading strategies, there are several things to consider:

- Risk management: Make sure your bot or algorithm has proper risk management strategies in place to prevent catastrophic losses.

- Security: Make sure your bot or algorithm is secure and cannot be hacked.

- Monitoring: Even if your bot or algorithm is trading automatically, you should still monitor it regularly to make sure it’s performing as expected.

- Market conditions: Make sure your bot or algorithm is designed to adapt to changing market conditions.

Automating your Bitcoin trading strategies with bots and algorithms can save you time and effort and can help you make better trading decisions. However, it’s important to consider the risks and to monitor your bot or algorithm regularly. With the right strategy and tools, you can take advantage of the lucrative Bitcoin market with minimal effort.